Like many other business owners, you’re always on the lookout for benefits for small businesses during COVID-19. While the initial impact of COVID is letting up, small business owners and entrepreneurs are still focused on finding financial relief or benefits that can help them navigate these unprecedented times.

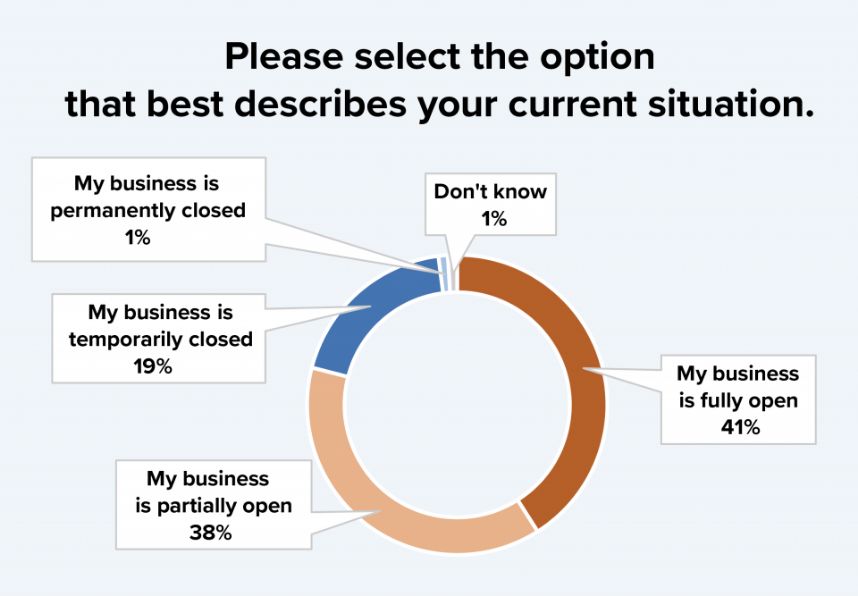

According to a recent poll by the U.S. Chamber of Commerce and Metlife, small businesses are seeking out loans, cutting back their hours, and focusing on how to keep their employees paid as well as how to keep their customers safe during this season.

Source: U.S. Chamber + MetLife Small Business Coronavirus Impact Poll

Nearly 80% of those small business owners anticipated increasing or retaining the same staff in the next year. To do that, you need to take advantage of all the helpful resources out there for small businesses like yours.

GOVERNMENT RELIEF PROGRAMS AND BENEFITS FOR SMALL BUSINESSES

First, be sure that you have exhausted your current options as the deadlines for PPP loans are coming up soon.

Paycheck Protection Program (PPP)

This loan program offers loan forgiveness to companies using the funds to retain employees.

There is an upcoming deadline, so be sure to apply quickly. For those who miss out on this, there is a P4 Act being discussed in congress which would give an opportunity for another round of funding specifically for small businesses with 100 employees or less.

Economic Injury Disaster Loan (EIDL)

This loan program is aimed at providing economic relief to small businesses as well as non-profit organizations experiencing a temporary loss of revenue due to COVID-19.

This loan program is specifically for small businesses that have a current relationship with an SBA express Lender to get access to up to $25,000 quickly.

This program offers a financial reprieve to small businesses experiencing difficulties due to the COVID-19 pandemic. It essentially helps offset principal and interests or fees associated with borrowing funds as well as microloans for 6 months.

If your operations have partially or fully suspended as a result of orders from a government authority due to COVID-19, or you experienced a decline in gross receipts by more than 50% in a quarter compared to the same quarter in 2019 you may be eligible for this tax credit. Unfortunately, employers who receive a PPP loan are not eligible for this specific tax credit. Note: This is not related to the Coronavirus Tax Relief for which small businesses are eligible.

COVID-19 Resource List for Employees and Employers from Gusto

Gusto, an onboarding platform for small businesses, has created an up-to-date list of federal, state, and local relief opportunities for small businesses including main street lending programs, mortgage relief, and loan relief programs — as well as dozens of other resources.

PRIVATE RELIEF FUNDS, LOANS, AND GRANTS FOR SMALL BUSINESSES

In addition to government relief sources, there are private companies and organizations offering grants of all sizes to eligible small businesses.

Their mission is to drive economic mobility by delivering affordable capital and responsible financial solutions to determined entrepreneurs. They launched a Small Business Relief Fund to raise $50 million to help borrowers in California and across the country with debt relief, loss mitigation, and help provide small business owners with new loans.

National Association for the Self Employed (NASE) Grants

NASE members can apply for small business grants of up to $4,000 each to help finance a particular need whether that’s updating computers or hiring part-time help.

GoFundMe has partnered with companies including Yelp, Intuit, Quickbooks, and more to create The Small Business Relief Fund. The fund will offer one-time matching grants to qualifying small businesses in hopes of helping to alleviate financial hardship.

Beauty Relief Grants are specifically for professionals in the beauty industry. They are offering $1,000 grants for licensed beauty pros who have lost work due to COVID-19.

American Federation of Musicians — Emergency Assistance

The Musicians’ Relief Fund helps union musicians who work gig-to-gig and are experiencing significant difficulties due to COVID-19.

This has benefits for small businesses during COVID-19 as well as being a standard feature. Find grants that you or your business can qualify for and never miss a deadline.

BUSINESS PERKS FOR SMALL BUSINESSES

They may not always be direct cash in your pocket, but ad credits from companies like Google and Facebook can equal higher sales, so don’t overlook their benefit for small businesses.

According to Google, $340 million in Google Ads credits available to all small businesses with active accounts over the past year. Credit notifications will appear in their Google Ads accounts and can be used at any point until the end of 2020 across Google’s advertising platforms.

While this money may not be able to go directly to offset any direct losses, it does give small business owners an opportunity to pivot during this season. If you haven’t used Google ads before, this is a great time to try to get in front of new clients with a potential new service — and if you have, now is a good time to increase your efforts without adding to your cost.

Eligible small businesses can apply for Facebook’s ad credits and cash grants. They must have between 2-50 employees, have been in business for over one year, and have experienced challenges from COVID-19 among other factors.

OTHER BENEFITS FOR SMALL BUSINESSES

In addition to the obvious grants and loan programs, small businesses should reach out to their service providers such as landlords, credit card companies, utility companies, your bank, and more. From Wells Fargo and Chase to AT&T to Verizon, companies are waiving fees and in some cases providing free access. Be proactive about asking what benefits are available for your small business.

Also, companies like Cisco Webex and GoToMeeting are offering discounted or free trial services for companies who have had to go virtual.

Make time to review all your options and don’t be afraid to ask what programs are available during this time. While you’re reviewing, make sure you’ve not missed any of the basics when it comes to COVID-19 Relief. Check out Wed Society’s COVID page with tons of helpful content all in one place.

__

Written by Corrie McGee